Talk of a ramp up in Chinese government activity and strong grid expenditure data has perked up some interest that demand will perhaps not be as bad as current price weakness warrants.

Betting against policy makers ability to turn growth around hasn't really worked over the past few years. But for me it is too early to believe that what they plan to do is enough to slow the weakness already in train, with it better to wait for evidence of stabilisation in activity rather than assuming its around the corner.

Relative supply dynamics are also playing a key role in weakness in copper vs other metals. While there have been some announced disruptions to mine supply, this doesn't appear to be anything out of the ordinary.

Indeed, the sell-off in copper has been more aggressive than metals like zinc and lead, suggesting the role of China in absorbing additional ex-China supply has been more important in the last 12 months or so and will continue to be so.

This contrasts starkly with nickel, where prices have rallied on supply curbs from Indonesia, although refined nickel inventories have mostly risen in the past few months.

The most recent trade data for February shows that whilst Chinese imports of refined copper imports dropped from huge January levels, they are up strongly from 2013 levels, rising 47%YoY over the two months combined.

The problem is that this is starting to look more like a supply push of copper into China rather than stronger demand. Bonded warehouse stocks have by all reports expanded much more rapidly over January and February.

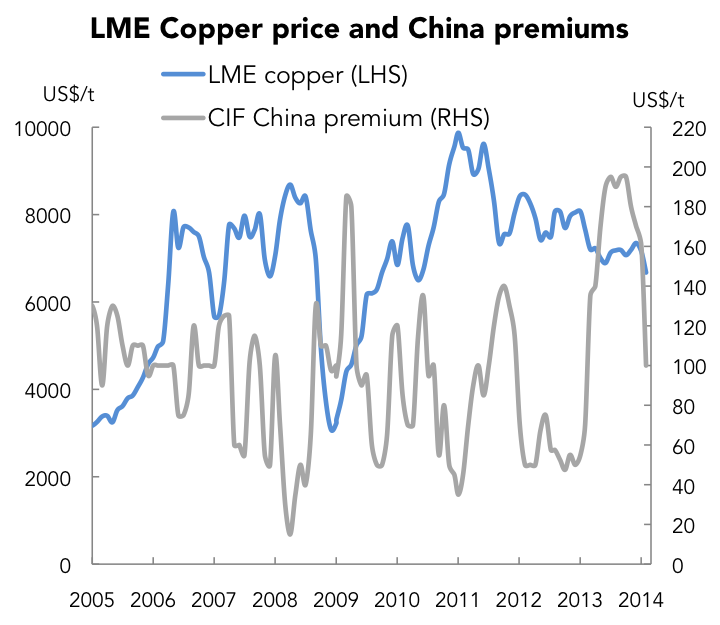

With incremental financing demand currently weak, prices have moved lower to incentivise other buyers.

If the latest ICSG numbers are to believed, it may not be too hard to believe that additional demand can absorb the loss of financing interest. For the full year 2013, the ICSG estimates a fairly chunky preliminary deficit of 450kt when incorporating their estimates of Chinese bonded warehouses movements. That said, their data seems to assume a large destock at the start of 2013 than some of the banks do. The key question is, however, even thought the deficit is pretty big compared to a projected surplus, why have prices been falling for over a year?

Also of note is that copper spreads have narrowed, with the backwardation recently seen to 3 months now much closer to zero.

A seasonal lift in activity should stop the curve from moving into contango. But the degree to which it lifts vs. last year will define how strong the spot price will be. At present the risk is that this is weak, although the balance of risks is starting to shift.