Additional total social finance fell YoY, slowing the growth rate of finance outstanding to 16.8%YoY. This is still fast, although tighter monetary is helping to put the breaks on the rampant growth in new lending seen this time last year.

There has been an interesting divergence in the rate of growth in different kinds of "shadow banking" lending in Q1. Trust loans, which are those facilitated via wealth management products and have been under the most pressure from defaults, have seen a rapid drop off in growth.

This segment will remain under pressure as default risks rise for those who have tried to chase higher yields.

Entrusted loans, however, have been relatively strong. These are different to trust loans in that the lender specifically specifies where the funding is going. The transaction is facilitated by a bank between the two parties, but the bank assumes no loan risk.

A trust loan is typically less direct, with the managers of the trust providing loans based on criteria chosen by the client.

While there is perhaps a switch in intermediation of funds between these different types of products, the aggregate flow of loans is still down 25%YoY.

A narrower measurement of financing activity is M2 money supply, which at 12.1%YoY is the weakest it has been for a decade.

Regardless of the nuances of financing activity that is and isn't captured by this measure, it is still a decent leading indicator of industrial activity. Better growth in M2 appears to be a prerequisite sign that easier monetary policy is working. This is not the case so far.

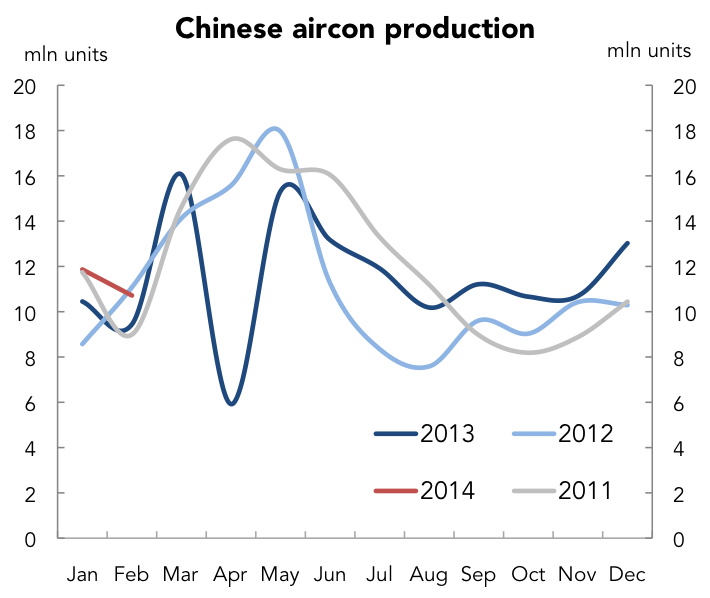

As the chart left shows, we are for example heading into the peak period of air conditioner production in China. Same story goes for steel as activity lifts before the summer lull.

But this support for physical consumption and spreads won't last. It could also give way to very weak consumption activity if the outlook darkens for Q3.

The same logic also applies to financing demand for commodities. It seems that the mood from CESCO, one of the largest copper conferences, was that financing deals aren't and won't unravel quickly and China should be able to absorb additional global supplies at a decent price.

This misses the point that it would only take an end to additional financing deals for this to materially impact copper demand and prices. It also misses the point that the pressure on financing activity is also likely to have an impact on consumption with a lag.

Chinese policy makers have, on a number of occasions, caught the falling knife before things got too nasty. But assuming that will be the case is risky given we actually haven't seen a huge amount of weakness just yet and leading indicators continue to soften.