In the next few weeks we should get a better idea of what has been happening with real activity in China in the past 2 months. So far we know that credit and money supply have been very strong and Chinese prices for steel, iron ore, coking coal and thermal coal have gone up to varying degrees.

But has this driven by an improvement in demand for these commodities? Or is it also a function of supply changes following steep price declines seen at the end of 2015?

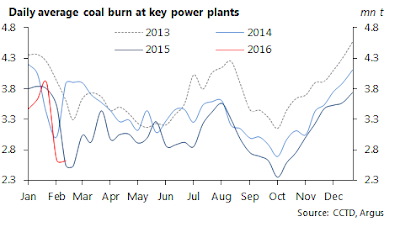

So far partial information suggests the rally in some commodity prices hasn't been driven by rising demand in the past two months. For example readings on coal-burn at sample power plants have been shrinking compared to this time last year, even when adjusting for the timing of the lunar new year.

Steel production from CISA mills was also sharply lower in January, although the declines in February compared to 2015 are not as severe. This is a little surprising given the timing of the lunar new year was earlier in February in 2016.

But just because real demand hasn't risen yet, doesn't mean that it won't in coming quarters. And the probability that demand will improve has shifted following the policymaker action of the past month or so.

Any improvement in demand is likely to be modest, with it perhaps more likely that the falls in demand for steel and power will simply stabilize. But for some commodities this is enough to change the price risks given supply is currently shrinking and inventories in some cases are well below levels seen this time last year.

For example, coal stocks at ports and power plants are drastically lower in terms of days of use compared to this time last year. The surge in inventory following a demand disappointment in early 1Q15 has been replaced by supply discipline that has kept inventory low. Inventory in terms of days of coal burn and coastal shipments has fallen by almost 14 days by the end of February.

For commodities like iron ore, which has seen a very sharp rally, its likely that expectations of stronger demand will have to be met to lock in the recent gains. For coking and thermal coal, the upward trajectory has been much more mild, with there perhaps more upside to come if demand does start to stabilise.