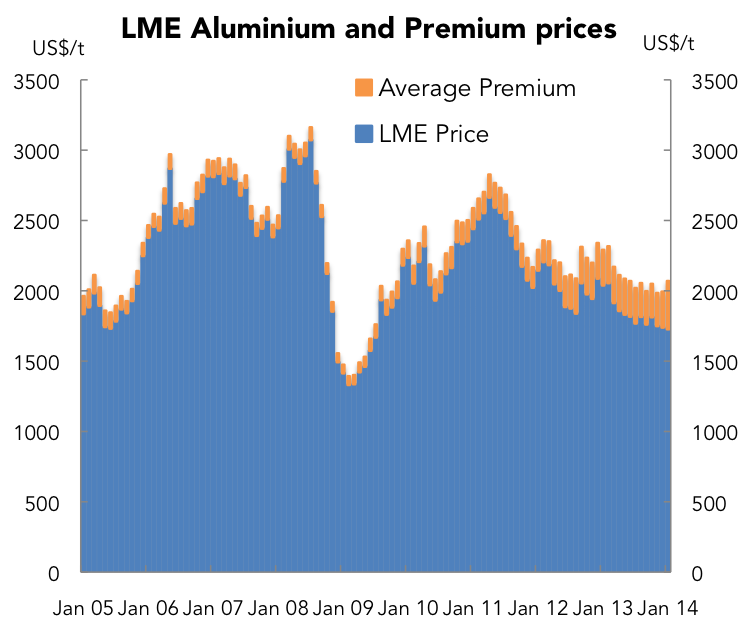

Also, its not just owners of warehouses that benefit from rents or traders from higher premiums, but producers also capture the benefit of very high aluminium premiums. And with LME aluminium at very low levels, strong premiums are helping keeping many producers in business. The alternative to this story is the death of a large chunk of North American aluminium production.

The situation with other base metals is different to the extreme case of aluminium. Zinc does have some financing deals tying up metal in warehouses, but for copper and nickel this is not the case. The issue here is that metal has been concentrated into a few locations which are operated by Pacorini/Glencore, but this is not a riskless enterprise like financing deals are.

Finally I would add that the LME rule changes haven't affect premiums because at this stage they are not binding. That changes as of the 1st of April, when warehouses like Vlissingen and Detroit will have to load out the culmulative additional metal that have gone into these warehouses since 1 July 2013. At the moment this stands at ~230kt.

So while the rule changes won't affect incentives for financing deals, they should affect the concentration of metal in warehouses and subsequently premiums.