The prospect of further yuan depreciation, along with the violent moves in Chinese stocks markets is sending shockwaves through global financial and commodity markets in a similar fashion as in July/August. The fall out from that episode did seem to have consequences for the real economy, with hopes of a modest change in Chinese economic momentum in Q4 ultimately proving too optimistic.

The consensus is building that the yuan will probably be around 5-10pc lower in 6 months, which is not really dramatic in the context of daily movements in many markets. But its not so much the depreciation on its own causing concern, but what it says about perceptions on the Chinese economy and the ability of policymakers to keep the transitions underway in the economy and financial markets from derailing into something more problematic.

Understanding Chinese capital flows and the onshore/offshore yuan dynamics is not straightforward. The RBA has just published a nice piece outlining Chinese capital flows and RMB settlement in the context of capital controls in this article.

Of particular interest is that its the RBA's assessment that the part of capital account that is often attributed to "hot money" flows is more likely to be unrecorded trade credit and advances. But ultimately the direction of this is driven by expectations of Yuan appreciation or depreciation, as trade firms decide to hold foreign currency rather than repay foreign currency loans.

We flagged 2 years ago that it looked like the RMB was too strong, but it hasn't fallen much since then. Calls for a very big depreciation in this context seem to be too bearish.

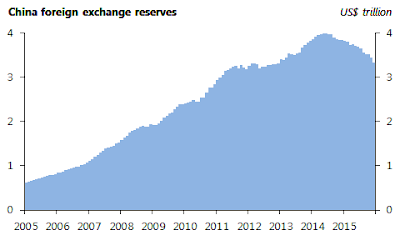

So far the shift in capital flows that has put downward pressure on the Yuan hasn't really affected domestic credit markets due to the PBoC's ability to sterilise these outflows via selling foreign exchange reserves. The fall China's foreign exchange reserves were the largest on record in December, with the level still standing at over 3.3 trillion dollars.

Many analysts often comment that China's massive FX reserves are some kind of "war chest" that they can spend to boost the economy if they really needed. But this has always overlooked the impact that this kind of capital flow would have on the Yuan. As long as policymakers remain committed to guiding exchange rates, then these reserves can only really be used to lessen the impact of very large changes in capital flows rather than spent as some kind of fiscal stimulus.

Ensuring that the path to capital account and broader financial market liberalization does not exacerbate booms and busts in the real economy is the key priority for Chinese policy makers. A big depreciation in the yuan to satisfy the concerns of some about the current trajectory of the economy doesn't really seem consistent with this and in some ways could exacerbate the weakness by creating financial market panic.

Could financial markets force this to happen against the will of Chinese policy makers? It really depends on how weak the Chinese economy will be over the next year or so. In the event of a very sharp slowdown in growth, the PBoC would probably exhaust its FX reserves pretty quickly as the market seeks a much much lower Yuan to compensate for the risks. But if growth shows any signs of stabilising or impoving a little, then markets probably won't be nearly as confident of taking on the PBoC. We think the latter is more likely.