Most of the Chinese data November data were a little better after a very weak October. Industrial production picked up a little, steel production declines were not as severe and power consumption grew modestly after 2 months of declines.

The signs from early December suggest that the November data are not signs of a more meaningful turning point in Chinese macroeconomic momentum.

Steel prices have edged higher more recently, although this has to be put in context of the scale of weakness in production rates. The CISA data for the first 10 days of December were down sharply compared to this time last year.

The modest fall in the level of inventory also doesn't suggest apparent demand is rising. On a days of production basis, inventory at mills has risen.

It does appear that the narrower YoY decline in the November crude steel production data were more a function of weak comps, with November 2014 particularly low in the context of 4Q14.

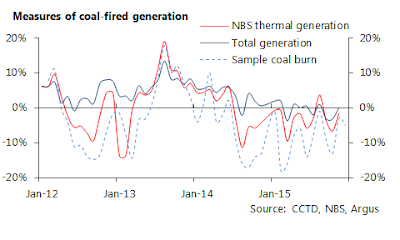

Coal burn at key power plants declined by ~5pc YoY in the first 10 days of December. This is a fixed sample and given new coal capacity continues to come online, the decline in total coal usage and thermal generation is unlikely to be as weak.

But it nonetheless appears to be falling, suggesting total power consumption is probably close to flat YoY.

The other interesting development in the coal space is the dramatic drop in inventory at ports. Stocks at Qinghuangdao at at the lowest point in a year, with significant destocking at most other ports as well.

Outbound shipments from ports have been falling sharply in 2H15, so port inventory should be coming done. Even so, inventory is now low in terms of days of shipments compared to the last 3 years, especially for this time of year.

This inventory drop doesn't appear due to particularly strong demand as pointed out earlier, with supply to ports reportedly becoming more difficult given cold weather. Upcoming annual contract negotiations may be leading major producers to try and push spot prices higher, but so far this hasn't worked and would be a major departure from the strategy of the last 12 months push to reduce costs in light of very weak markets.

While logistics are playing a role, it may also be a sign that current prices are too low to incentivize supply to meet even a seasonal uplift in demand. Chinese thermal coal prices dropped around 10pc following the disastrously weak October, but so far have not recovered as demand has improved a little and inventory fallen. Pressure does appear to be building for prices to move higher.

But from a macroeconomic perspective, it wouldn't be a signal that power demand and the broader industrial economy is genuinely improving, at least not yet.